Market making Bots for Raydium

Raydium market maker bots.

Swap – Raydium SOL.

1. Types of bots

pump bot, dump bot, counter trade bot, daily bot, volume bot. Price holding, accumulation, distribution.

2. Ready-made scenarios

Daily Smooth Buy Bot, Daily Smooth Sell Bot, Volume Bot, Pump Bot, and others.

MM Tools has a strategy of auto-following the token price on one exchange after another.

3. Volume and chart on DEX

Raydium volume bot. Market Maker Tools bots allow you to increase trading volume on Solana and manage the token price chart.

The Best Bots for market makers. Market maker Tools works with the most popular blockchains and DEX in the industry

If you need to use the vast potential of promoting a token on DEX, go to the next level with our powerful Bots!

• Solana NEW

• TON NEW

• TRON NEW

• Avalanche NEW

• Ethereum

• Base

• BSC

• Arbitrum

• Polygon

• Ston.fi TON NEW

• ORCA V1/V2 SOL NEW

• Raydium SOL NEW

• Meteora SOL NEW

• SunPump TRX NEW

• DeDust TON

• Trader Joe AVAX

• Uniswap V2/V3 BSC / ETH / Polygon / Arbitrum / BASE

• Sushiswap V2/V3 BSC / ETH / Polygon/ Arbitrum / BASE

• PancakeSwap V2/V3 BSC / ETH

• QuickSwap V2/V3 ETH / Polygon

Using our service, you can trade pairs to SOL, TON, ETH, BNB, POL, ARB, AVAX, TRX, USDT, BUSD, USDC, BTCB.

If you need to use the vast potential of promoting a token on DEX, go to the next level with our powerful Bots!

Raydium Volume Bot. Make your token more liquidity in one day.

Manage multiple tokens and wallets from one screen!

![]() Beginner

Beginner

1 wallet, 2 bots

$299/month

![]() Advanced

Advanced

2 wallets, 5 bots

$599/month

![]() PRO

PRO

50 wallets, 50 bots

$899/month

![]() Rocket

Rocket

100 wallets, 100 bots

$1999/month

Fully managed service, 24/7 solution

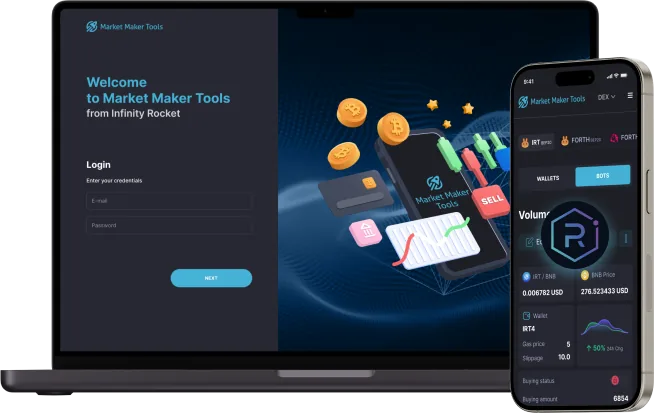

Infinity Rocket provides market making solutions for crypto projects and crypto exchanges. We help projects achieve their business goals. Make your token successful with the Market Maker Tools.

See how the tool works.

Easily set up Market Maker Tools, start managing your token on Raydium!

Market Maker Tools allows you to create a large number of trading bots for performing various market maker tasks: price holding, accumulation, distribution, providing necessary price impulse.

Plot your own chart on DEX

Start managing your token efficiently. Your token will be attractive to traders

Use a large number of trading bots working simultaneously

Manage all your bots with one convenient tool.

Control token’s liquidity and volume

The tool allows you to manage the trading volume, accumulate and distribute positions.

Get trial period MM Tools

Connect to the tool and get 72 hours of free trial Market Maker Tool.

Raydium Market Maker Bot

If you’re seeking a simple and effective way to trade on Raydium, our Raydium Market Maker Bot is the good solution. We offer user-friendly and intuitive market maker bots to manage the price chart of your token on exchanges. You can set Volume and Impulse very quickly and without the need for any coding, just try our Raydium Volume Bot.

With our bots, you don’t need to be a Raydium Exchange expert to boost your token’s visibility by creating impressive stats. Definitely, we prioritize high levels of safety and privacy for our users. Our goal is to ensure smooth and efficient operation on DEX using our Raydium Trading Bots. We increase the effectiveness of your marketing with the help of affordable and professional Market Maker Tools for Raydium.

Disclaimer: We do not provide market-making services, such as price manipulation, volume increase, or pump-and-dump schemes. Our service offers bots to automate trading on decentralized exchanges (DEX). Clients are responsible for the actions of their bots. They are also responsible for managing price, volume, and trades at their own risk and expense.

© 2026, Infinity Rocket